The escalating tensions in the Black Sea region heaped fresh risks on global food markets already struggling with soaring prices, supply-chain disruptions, and a bumpy recovery from the pandemic. Before the Ukraine crisis, overall conditions in markets for staple foods looked reasonably favourable and seemed to augur for softening prices during 2022, even as sharply rising food prices in domestic markets in many developing countries continue to raise concerns about greater food insecurity. The escalation of the conflict is now putting markets into serious turmoil.

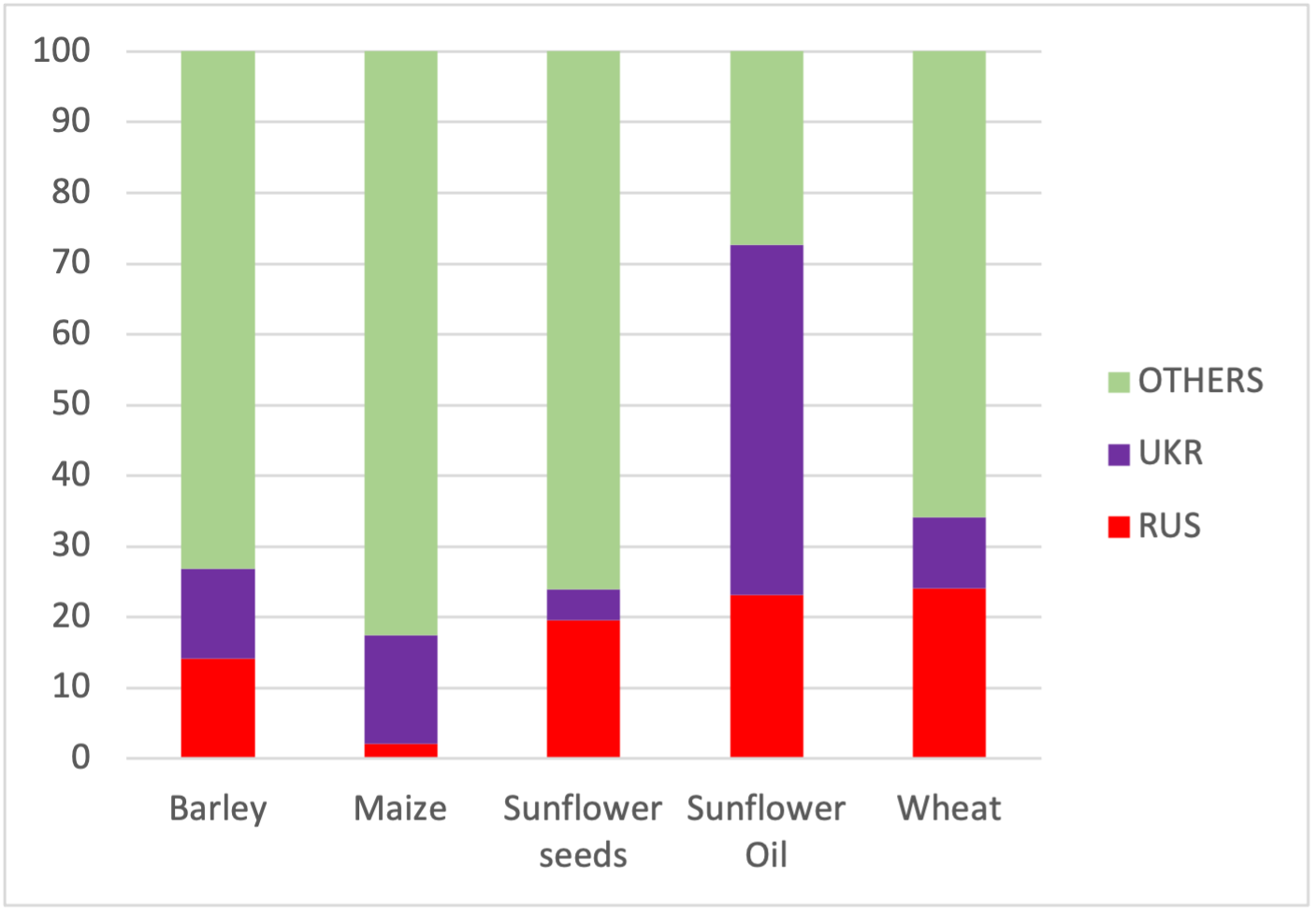

Financial markets reacted immediately to the invasion, with stock markets sinking and commodity prices soaring. The price of oil jumped past US$105 a barrel on February 24. Ukraine and the Russian Federation combined account for more than 30% of global wheat exports. The harbour of Odessa and the Black Sea serve as major conduits for international grain shipments from Ukraine, and the country is also among the top exporters of barley, corn, sunflower and other oilseeds. Russia and Ukraine are breadbaskets, exporting millions of tons of wheat to food import-dependent developing countries in the Middle East, South Asia, and sub-Saharan Africa. Ukraine and Russia each provide about 6 percent of the globally traded supply of food energy in kilo calories (see Figure 1). Any serious disruption of production and exports from these suppliers will no doubt drive up prices further and erode food security for millions of people. Indeed, international spot prices for hard wheat rose to near US$10 per bushel on February 28, 2022, their highest level since March 2008. Wheat prices in futures markets have been showing very high volatility for already more than 100 days, according to IFPRI’s Food Security Portal.

While Ukraine no longer is a big producer of the key ingredients for fertilizers such as urea and potash, the Russian Federation is. Disruptions in those supplies and rising prices for oil and gas, would further drive up fertilizer, and, hence, also food prices.

It is still too early to foresee the full ramifications of disruptions in the supply of key food staples from Ukraine and Russia as well as the implications of a prolonged rise in oil and fertilizer prices on agricultural markets. Wheat harvests in the two countries will occur during the European summer, so some of the impact will depend on how the invasion will play out in terms of affecting production in the Russian Federation and Ukraine, and for how long export channels will be blocked.

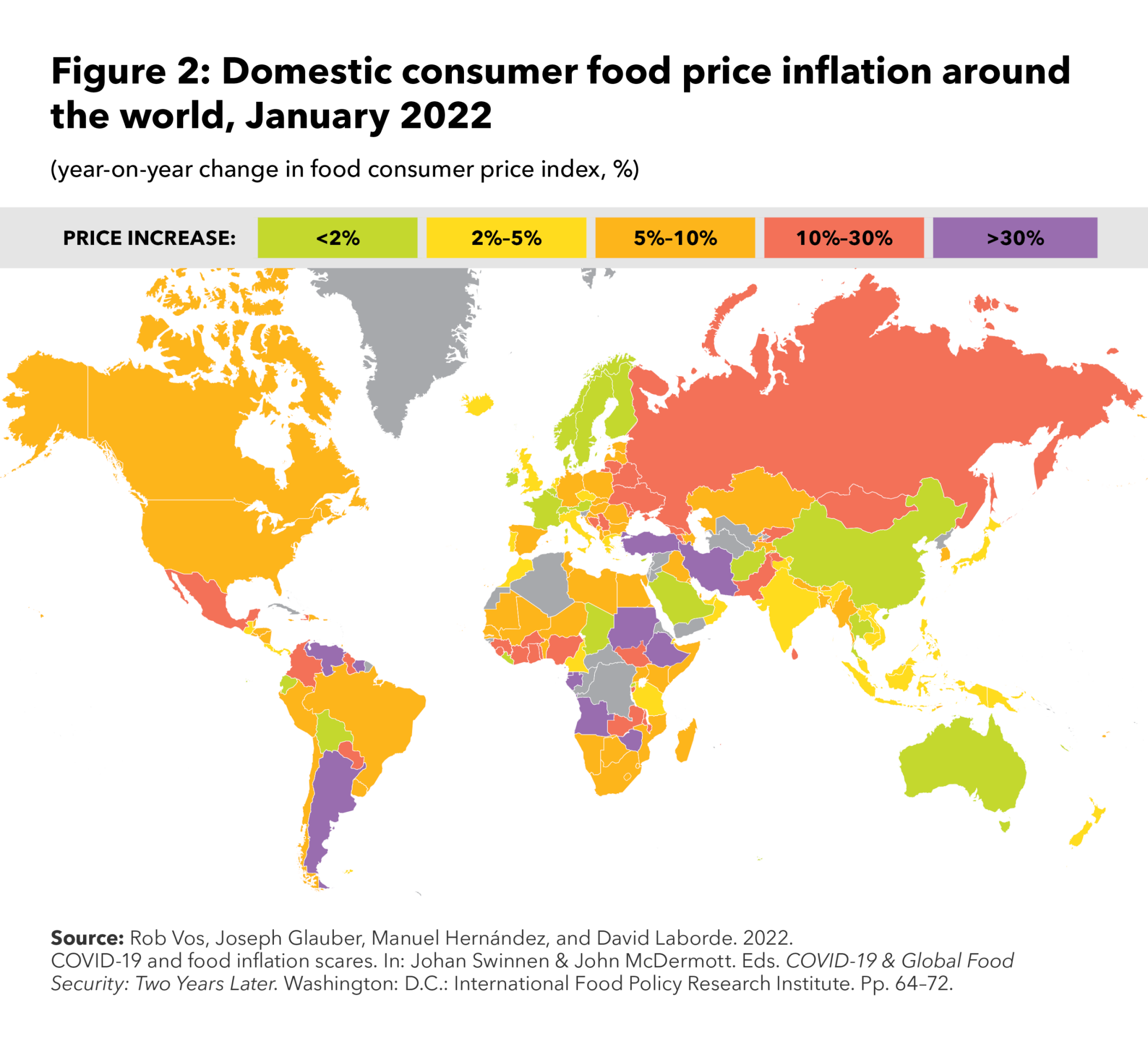

In the near term, food prices in world markets should be expected to rise further amidst all uncertainty, and this will add to global food insecurity. This will also fan consumer food price inflation which had surged already during 2021 (see Figure 2), especially in low-income countries, but also in Ukraine and the Russian Federation. Poor farmers may earn higher incomes from increasing food prices, but most are net consumers of food. Governments of low-income countries have very limited fiscal capacity to protect the purchasing power of low-income families and prevent higher food prices from causing greater food insecurity and further deterioration of diets. Given the global ramifications of food price inflation, strengthening this capacity through additional financial assistance should be an immediate priority for the international community.

Figure 1 Global market shares for key agricultural exports from Ukraine and Russian Federation (percent)

Source: COMTRADE and IFPRI Trade in Macro-Nutrients database. Refers to average for 2018-2020 (Intra-EU flows excluded from total). See also: Joseph Glauber and David Laborde, How will Russia’s invasion of Ukraine affect global food security? IFPRI blog February 25, 2022. https://www.foodsecurityportal.org/node/1919