Significant Volatility in Soybeans But Supply and Stocks Still Good

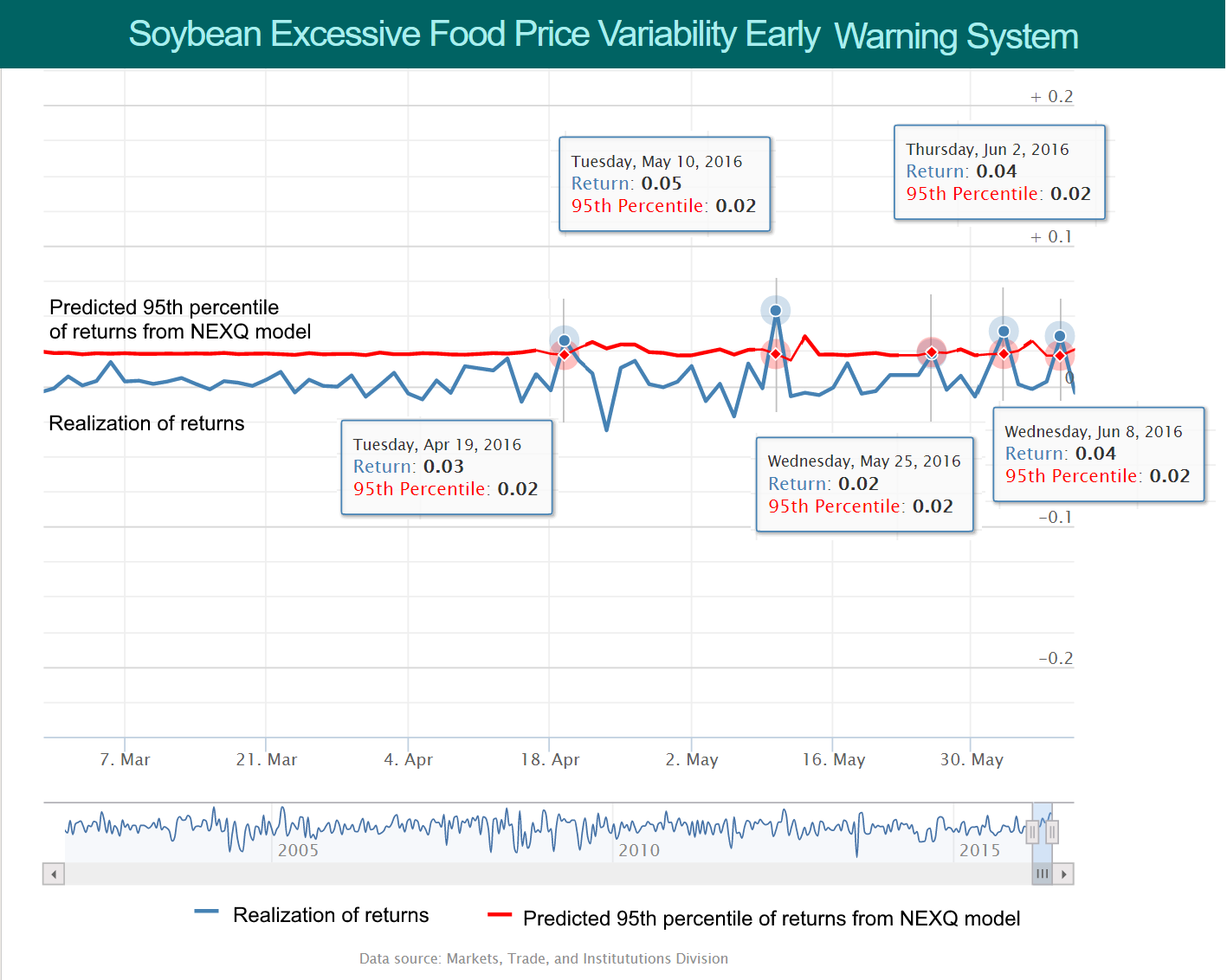

Soybean futures prices have seen a lot of movement in recent weeks, beginning in April when they twice saw record daily trading in combined futures and options volume on the Chicago market. Our early warning excessive food price volatility system has immediately reflected this trend, identifying extreme positive returns, i.e. returns that exceeds the 95% conditional quantile predicted by our NEXQ model . The days in which we observe excessive volatility are identified in the graph below.

Soybean Excessive Food Price Variability

Our results are consistent with what the CME Group and the Agricultural Market Information System (AMIS) Market Monitor have reported regarding futures prices and weather trends. The main explanation as stated by them is that heavy rains in Argentina have threatened harvests in that country and have played a major role in the recent futures spikes. As of April 21, prices in the July futures contact had risen more than 8 percent in a week. This has resulted in several, nonconsecutive days of excessive price volatility since April.

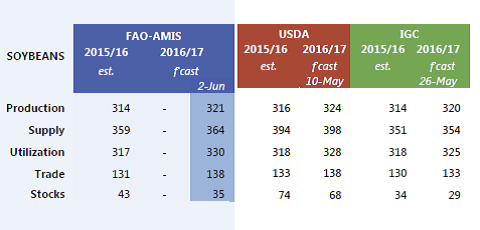

Belying these spikes, however, are the most recent soybean production estimates from AMIS, which tentatively forecast soybean production for 2016-2017 to increase slightly from 2015-2016 based on increased output from Brazil. This increase is expected to offset output reductions in the US, Canada, and Argentina. The latest Market Outlook also saw improved weather conditions in Argentina in May. While 2016-2017 utilization is also expected to increase, resulting in a drawdown of global stocks, AMIS still puts soybean ending stocks for 2016-2017 at 35 million metric tons.

World Supply and Demand Outlook for Soybeans

Source: AMIS Market Monitor June 2016

This estimated ending stock level, while lower than the previous year, is still adequate for global food security needs. Thus, the current period of price volatility reflects an initial overreaction in the market which we expect to smooth in the following weeks unless any other key exporting country is affected by a climate shock.

Prices for the rice traded in the Chicago exchange are also currently in a volatile period, having seen four consecutive days of excessive volatility over the past week. This trend is also being seen at the global level, where production forecasts for 2016 have been lowered due to reductions in supply from Brazil and China. Despite this, however, global rice stocks are still at 164 million metric tons. In addition, overall growing conditions are good in Southeast Asia, and Thailand continues its efforts to clear stockpiled rice.

By: Sara Gustafson, IFPRI

Files: