Outline

- 01Summary

- 02The dashboard

- 03Fertilizer market analysis by IFPRI & FSP

- 04Partners

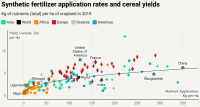

The dashboard tracks global fertilizer market trends, price drivers, trade, and production, helping users monitor risks and understand impacts on food systems.

Last update: October 2025

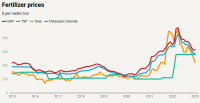

The outbreak of the war in Ukraine sent fertilizer prices soaring to all-time highs as prices for natural gas, a key feedstock for nitrogenous fertilizer production, drove production cutbacks and sanctions and export restrictions disrupted exports. These drivers of market turmoil intensified fears of reduced global food production and higher food prices. While global supply continues to rebound and prices abate, risks linger and monitoring market developments remains key.

The Fertilizer Market Dashboard provides you several ways to monitor the latest developments in fertilizer markets, including a summary of market developments and tools for tracking fertilizer trade, utilization, and production.

The dashboard

Fertilizer market analysis by IFPRI & FSP

Here you can find a selection of IFPRI and FSP analysis on fertilizer markets.