A Message to the Thai Government: Do Not Let National Policies Harm the Global Poor

- Evidence-Based Research

- Market Structure

- Policies, Institutions, and Global Initiatives

- Rice

- Trade

- Somalia

- Thailand

Related blog posts

A Commentary by Maximo Torero

Thailand’s rice exporters are warning that the country’s 2012 rice exports could drop by as much as 30-40 percent as the result of a proposed government policy that would guarantee fixed prices for both plain white rice and jasmine rice. The Pheu Thai Party, which was elected into power in July, has promised farmers fixed prices of 15,000 baht ($US 500) per ton for plain white rice and 20,000 baht (US$ 667) per ton for jasmine rice.

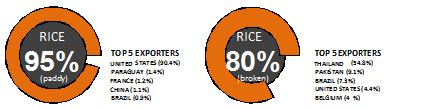

The global rice market is highly concentrated in a few countries—only a small share of production is traded (see figure below). Thailand holds more than half of the world’s share of exports in broken rice, which is the main type of rice consumed in most developing countries. In the case of broken rice, the top five producers account for roughly 80 percent of world exports. This high level of concentration implies that world prices for broken rice will immediately react to any reduction in exports by Thailand—and it is feared that the government’s proposed fixed-price scheme will severely limit Thai rice exporters’ ability to compete in the global market. This in turn will result in significantly higher prices and price volatility, with detrimental effects on the world’s poor.

Major exporters of rice, 2008

(% of WORLD EXPORTS)

With prices for Thai rice increasing, foreign customers will likely turn to competing exporters such as Vietnam and Cambodia. However, it is not yet clear if Vietnam and Cambodia, which have relatively small rice trade shares, would be able to cover the big deficits caused by a reduction in Thai exports. The Thai administration acknowledges this likely scenario, but says the proposed policy’s benefits for farmers in Thailand will outweigh the costs.

The costs are very high. The proposed policy will not only harm Thai exporters, who will no longer be able to effectively compete in the global market, but the resulting lower level of exports from Thailand and higher export prices will be detrimental to consumers worldwide. This is especially true for poor consumers in developing countries, who will be less able to purchase rice at higher prices or find a comparable substitute for the staple grain. Research across 11 countries in Africa shows that African rice prices are more closely linked to world markets than maize prices. Therefore, if Thailand decides to move ahead with the proposed policy, it will have significant consequences in countries that are net importers of rice, such as countries in West Africa and countries like Somalia, which are currently experiencing significant emergency situations and are in dire need of imported rice ( Watch Senior IFPRI Research Fellow Nicholas Minot discuss price transmission in Africa.)

While the Thai fixed-price proposal may benefit some farmers in the country, we believe that the tremendous negative global implications of such a policy far outweigh the limited benefits. Therefore, we urge the Thai government to seek alternative strategies rather than risk the well-being of so many of the world’s poor whose diets are heavily dependent on rice.

Files: