Global maize and soybean prices have skyrocketed in recent weeks and experts fear that price increases will be unabated as dry weather in the US Midwest continues for at least another week.

US corn crops have been hard hit by the drought conditions, which began in May and stunted crops in the crucial pollination phase. While US government officials argue that this year’s increased corn acreage will offset the drop in yields, agricultural and trade analysts fear that the length and severity of the drought could continue to have a substantial impact on prices (see Figure 1). Since June 1, the Chicago Board of Trade (CBOT) corn contract for December delivery has risen 30%, closing at $6.56 on July 2.

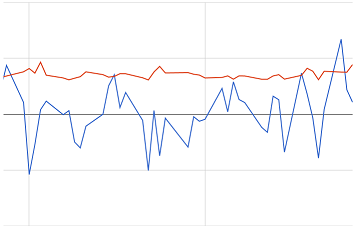

Figure 1: Weekly Global Maize and Soybean Prices, June 2012

Soybean prices have experienced similarly sharp spikes, seeing their highest levels in nearly four years (see Figure 1). The jump in prices has been caused by a combination of dry weather throughout the US and South America, decreased acreage in favor of more profitable corn, record levels of Chinese imports, and a subsequent rapid rate of stock disappearance. A June USDA report cites soybean disappearance of 707 million bushels in May, the second largest on record. Increased Chinese imports are being driven by strong demand from the Chinese crushing industry, reduced domestic soybean production, and stockpiling of soybeans to guard against any potential shortage resulting from US and Argentine droughts. Since June 1, CBOT soybean contracts for September have risen 14%, closing at $14.52 on July 2.

Evidence from IFPRI research suggests that excessive speculation in commodities markets can lead to increased price volatility , impacting agricultural production decisions, trade policies, and food security around the world. While the Maize Excessive Food Price Variability tool has not yet shown significantly higher volatility, realized returns have been above the forecasted 95th percentile returns in several instances (see Figure 2). The Soybean Excessive Food Price Volatility tool is showing moderate volatility and should be monitored.

Figure 2: Maize Price Volatility, April – June 2012

Red line = forecasted 95th percentile returns

Blue line = realized returns

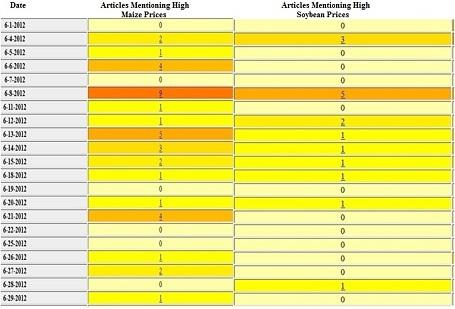

Media attention to corn and soybean prices has been consistently high in June (see Figure 3), highlighting the level of global concern about food prices. As seen during the Russian droughts of 2010 , however, it is important that policymakers not react with knee-jerk policies such as stockpiling and export restrictions. While such policies may appease the population of a particular country or region, they can have devastating consequences for global food prices and food security.

Figure 3: Media Articles Mentioning High Maize and Soybean Prices, June 2012

Files: